The Two Principal Kinds of Organizations: Figuring out Their Designs

The business world is different; however, there are two primary kinds of business structures at its establishment: sole ownership and organizations. Each design offers particular benefits and hindrances, taking special care of various necessities and sizes of activity. This article dives into these two principal business structures, making sense of their attributes, advantages, and disadvantages, and how to pick the right design for your endeavor.

Table: The 2 Primary Kinds of Organizations

Table: The 2 Main Types of Businesses

| Business Structure | Description |

|---|---|

| Sole Proprietorship | A business owned and operated by one person. There is no legal distinction between the business and the owner. |

| Partnership | A business co-owned by two or more people who share profits, losses, and management responsibilities. |

Figuring out the Key Distinctions:

• Possession: In sole ownership, the proprietor holds sole responsibility for the business and all its resources. Organizations disperse proprietorship and benefits (or misfortunes) among the accomplices, as illustrated in an association understanding.

• Obligation: Sole owners have limitless responsibility, meaning their resources are in danger if the business brings about obligations or claims. Accomplices share responsibility as indicated by the organization arrangement, which can be restricted or limitless.

• The board: Sole owners have unlimited authority over the business’s choices and tasks. Accomplices share the board liabilities according to the arrangement, which can be equivalent or assigned based on ability.

• Arrangement: Sole ownerships are somewhat simple and economical to lay out, frequently requiring negligible customs. Organizations need an understanding of framing each accomplice’s freedoms and certain limitations.

Picking the Right Business Construction

The best business structure for you relies upon a few elements, including:

• The idea of your business: Consider the degree of hazard implied, the requirement for extra capital, and the intricacy of the executives.

• Your monetary circumstance: On the off chance that you’re awkward with limitless responsibility, an organization may be a superior choice.

• Development plans: If you envision massive development, an organization can allocate extra capital and mastery.

Here is a speedy manual to assist you with choosing:

• Pick sole ownership if You’re a solopreneur, have an OK business, and lean toward unlimited oversight.

• Pick an organization if You need to share proprietorship, abilities, and assets with a confided-in accomplice and are OK with shared risk.

Upsides and downsides of Sole Ownerships

Experts

• Simple to frame and work: Requires negligible conventions and desk work.

• Unlimited authority: Sole owners have full dynamic power.

• Keeps all benefits: The proprietor holds every one of the business benefits.

Cons

• Limitless obligation: Sole owners are by and by at risk for business obligations.

• Restricted admittance to capital: Raising assets can be trying as the business depends entirely on the proprietor’s assets.

• Hardships in scaling: Development might be restricted by the proprietor’s abilities and assets.

Advantages and Disadvantages of Organizations

Aces

- Shared assets and mastery: Accomplices contribution to capital, abilities, and experience, helping the business.

- Expanded admittance to capital: Organizations can raise more capital than sole ownership.

- Shared direction: Accomplices can profit according to different points of view and thoughts.

Cons

- Potential for conflicts: Accomplices need solid correspondence and compromise abilities to stay away from debates.

- Shared obligation: Accomplices share liability regarding business obligations and liabilities.

- Intricacies in line and activity: Association arrangements require cautious thought and legitimate guidance.

FAQs on Business Designs

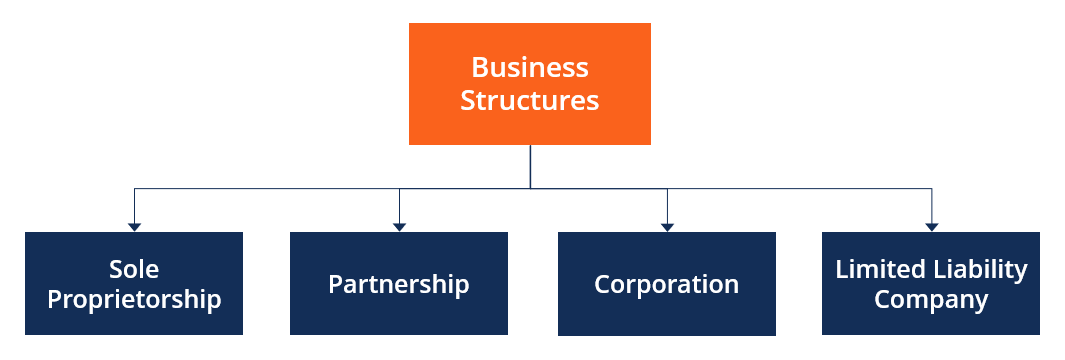

H3: Are there other kinds of business structures other than sole ownerships and associations?

Indeed, there are a few other business structures, including:

- Restricted Obligation Organizations (LLCs): Offers restricted risk security like a company with more extraordinary adaptability in administration structure.

- Companies: A different lawful substance from its proprietors, offering restricted risk insurance and the capacity to raise capital through stock issuance.

- Cooperatives: Organizations claimed and justly constrained by their individuals, frequently with a social or local area center.

H3: Can I c, change my business structure later?

Indeed, it’s feasible to change your business structure; however, it can include lawful and charge suggestions. Talking with a legal counselor and bookkeeper before rolling out such an improvement is suggested. <h3> H3: What elements would be a good idea to consider while picking a colleague?

Picking the right colleague is significant. Consider factors like:

- Integral abilities and experience: Accomplices ought to offer various qualities that would be useful.

- Shared values and vision: You and your accomplices ought to have a reasonable and adjusted vision for the business.**

Solid correspondence and trust